Integrity, Transparency,

& Personalised service

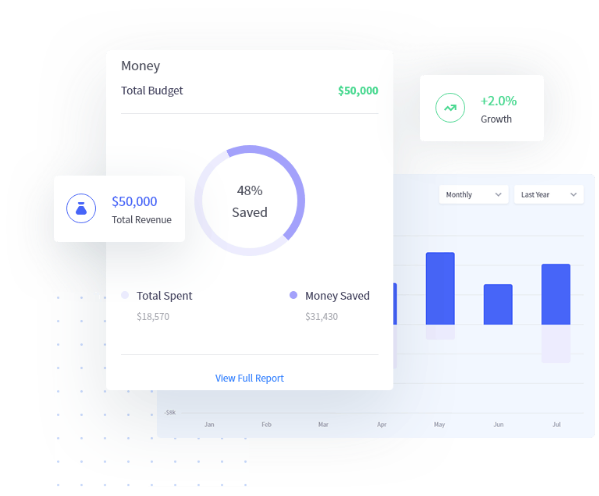

Empowering you to achieve financial goals with confidence.

At Jiaum Broking LLP, we are committed to providing tailored solutions to meet your unique investment needs. Whether you are an experienced trader or just beginning your journey in the stock market, our team stands as your trusted partner in building, managing, and growing your investment portfolio.